Buying enterprise software is awful. Consensus combines video, product interaction, and discovery automation to make buying easy. And our unique buyer insights drive wins 30% faster and with 2x the close rates.

in the world rely on Consensus to deliver more revenue through better buying.

G2 ranks us as the #1 Demo Automation platform in the world. Learn more about the history of demo automation.

Instead of forcing buyers into a rigid, sales-centric process, our platform gets them what they need when they need it. It then multiplies your revenue team’s impact with unique insights on those buyers. The result is faster close times, larger deals, and higher close rates for enterprise customers.

Multiply your revenue team’s impact by redefining the buyer experience.

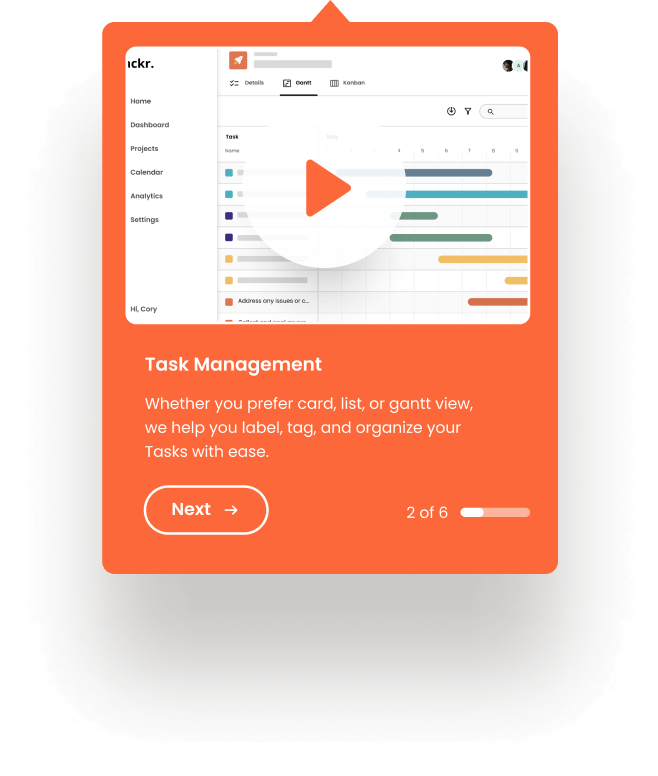

With product interaction, expert advice, and deep discovery, only Consensus delivers all the pillars of a fantastic demo on demand.

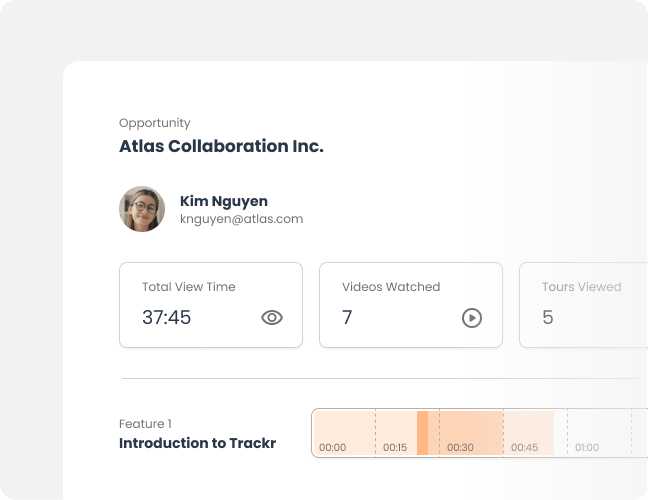

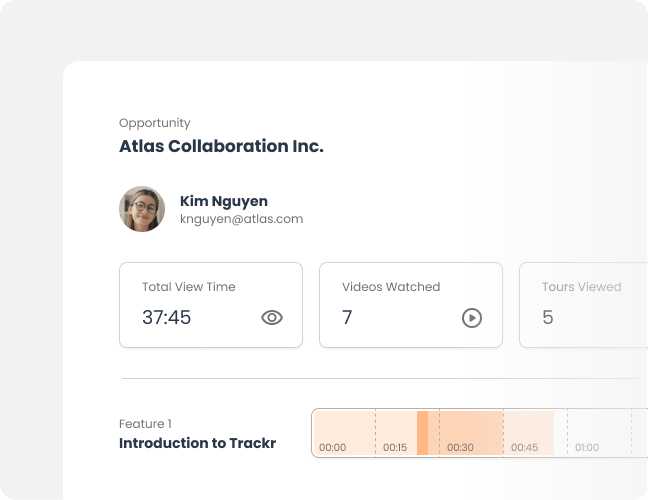

Consensus’ industry-leading engagement data helps you discover critical stakeholders, understand their buying intent signals, identify buying groups, and help them align.

Finally, truly actionable intent data that brings you faster close times, bigger deals, and higher close rates.

Consensus’ industry-leading engagement data helps you discover critical stakeholders, understand their buying intent signals, identify buying groups, and help them align.

Finally, truly actionable intent data that brings you faster close times, bigger deals, and higher close rates.

Consensus is the only enterprise-hardened demo automation solution on the market. 15 of the world’s top 30 software companies trust us with high-volume data, multiple products and locations, and world-class security. We’re the most heavily integrated solution with the most mature partner ecosystem, and we offer exceptionally dedicated, enterprise-level support.

Connect with our sales team today to discover how Consensus can empower your team with personalized, interactive demos, driving higher conversions, shorter sales cycles, and increased revenue.

Presales